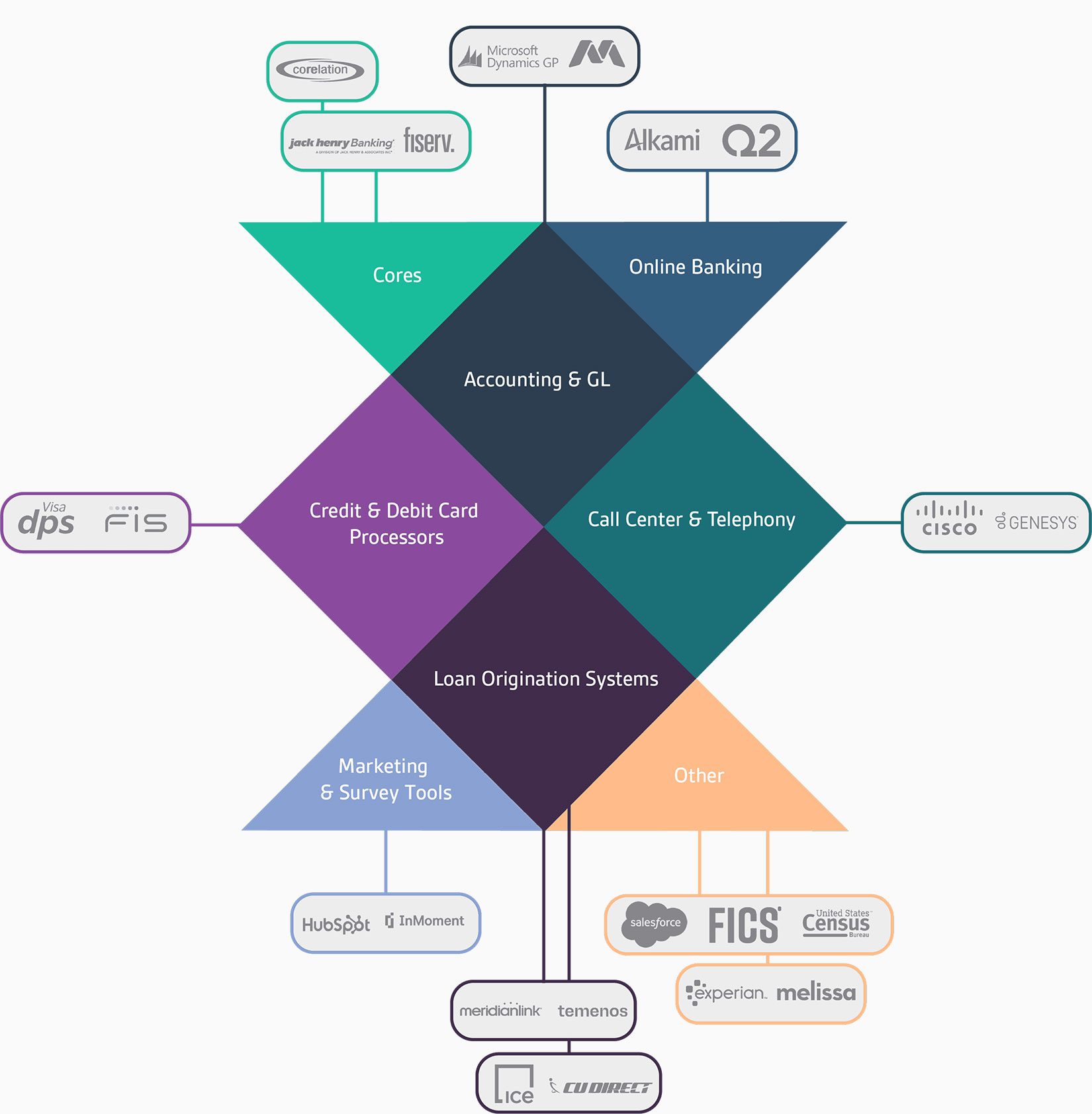

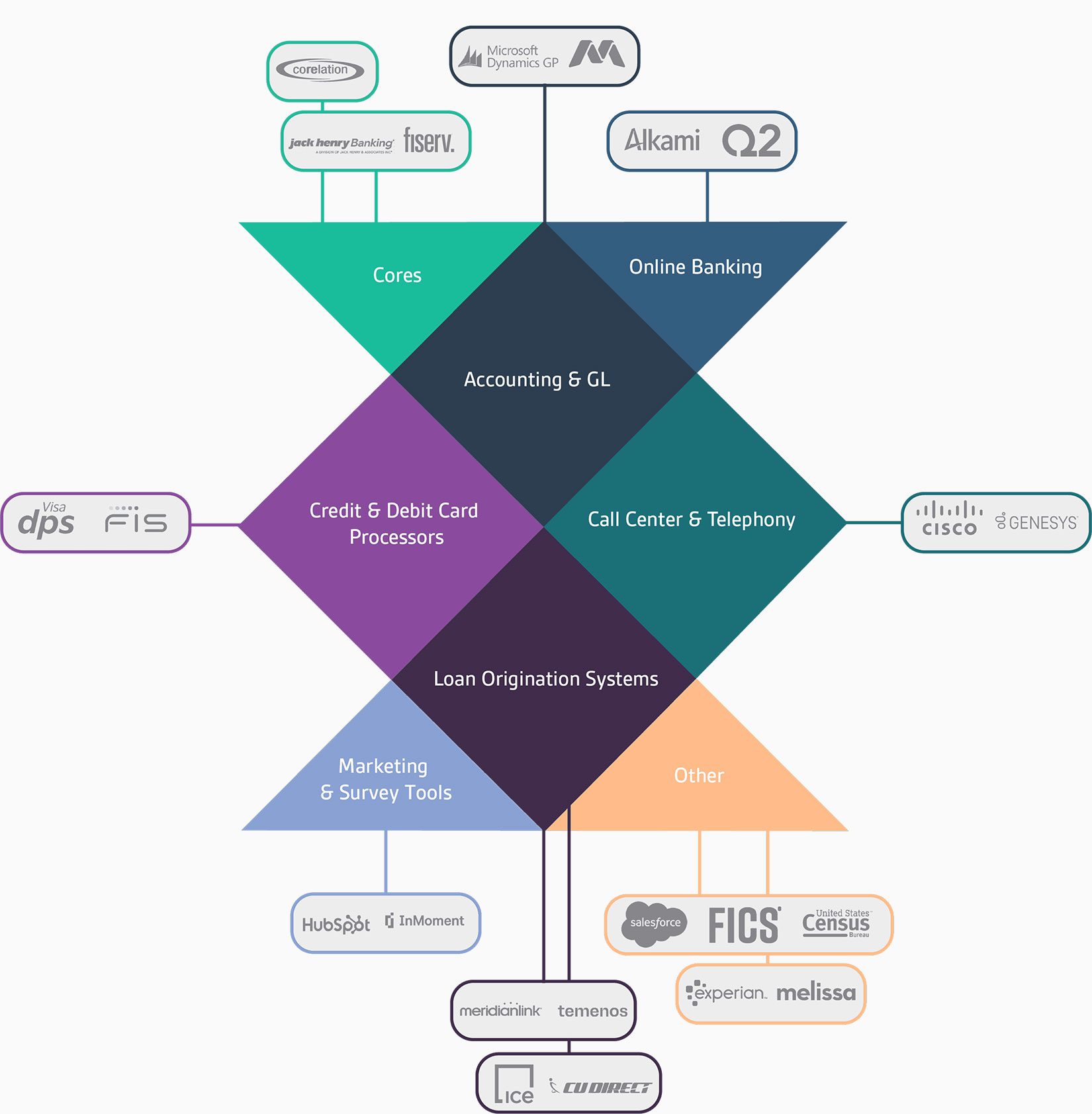

We currently support over 75 integrations – even the ones that other data analytics providers won’t touch. Our integrations incorporate leading credit union and bank solutions, like consumer loan and mortgage originations, digital banking, CRM / MRM, third-party data vendors, and more.

We selected Gemineye as our data partner due to their remarkable flexibility, competitive pricing, and unparalleled personal touch. Their commitment to tailored assistance made them the clear choice for our needs. Since our launch with Gemineye, our data analytics capabilities have allowed us insights into our business that we never had before.

We currently support over 75 integrations – even the ones that other data analytics providers won’t touch. Our integrations incorporate leading credit union and bank solutions, like consumer loan and mortgage originations, digital banking, CRM / MRM, third-party data vendors, and more.

When running a financial institution you know that data is an important part of your operations. You’re regularly collecting customer (for our bank readers) and member (for our credit union ...

Why Data Analytics Matters Data analytics is essential for staying competitive in today’s competitive landscape. A recent study by Jack Henry found that 42% of credit unions prioritize leveraging data ...

The Data Lakehouse Platform For Dummies, Databricks Special Edition, is about using the principles of a well-designed platform that leverages the scalable resources of the cloud to manage all of ...

Financial institutions like banks and credit unions are inundated with vast amounts of data daily. Effectively managing and deriving actionable insights from this data is crucial for maintaining a competitive edge. Enter the data lakehouse — a modern data architecture that seamlessly combines the strengths of data lakes and data warehouses. What is a Data Lakehouse? A data lakehouse is an integrated data platform that merges the flexibility and scalability of data lakes with the data management and transactional capabilities of data warehouses. This unified approach allows organizations to store all forms of data—structured, semi-structured, and unstructured—in a centralized repository. By applying a schema-on-read (a data management strategy where you store data as-is) mechanism, data lakehouses enable real-time analytics and machine learning directly on vast datasets without the need for extensive preprocessing. Importance of Data Lakehouses in Financial Services For financial institutions, the ability to swiftly process and analyze data is paramount. Data lakehouses address several critical challenges in the industry: Regulatory Compliance: With stringent and ever-evolving regulations, banks and credit unions must ensure accurate and timely reporting. Data lakehouses provide centralized governance and auditing capabilities, simplifying compliance efforts. Risk Management: The financial sector is fraught with risks, from fraud to market volatility. Data lakehouses facilitate real-time analytics, enabling institutions to detect anomalies and respond proactively. Customer and Member Personalization: Understanding customer behavior is key to delivering personalized services. By analyzing diverse data sources, data lakehouses help institutions tailor products and services to individual customer needs. Benefits for Banks and Credit Unions Implementing a data lakehouse architecture offers numerous advantages: Flexibility and Scalability: Data lakehouses can effortlessly scale to accommodate growing data volumes, ensuring that institutions can adapt to market changes and customer demands. Cost Efficiency: By consolidating data storage and analytics into a single platform, data lakehouses reduce the need for multiple systems, leading to significant cost savings. Enhanced Data Governance: With robust metadata management and lineage tracking, data lakehouses ensure data integrity and facilitate easier compliance with regulatory standards. Real-Time Analytics: The architecture supports immediate data processing, allowing institutions to make informed decisions swiftly, which is crucial in the fast-paced financial sector. Gemineye: Your Partner in Data Transformation Gemineye specializes in empowering financial institutions to harness the full potential of their data. Our cutting-edge data lakehouse solutions are designed to meet the unique challenges faced by banks and credit unions. With a focus on flexibility, scalability, and security, Gemineye ensures that your institution can navigate the complexities of modern data management with ease. Transform your data into a strategic asset. Partner with Gemineye to revolutionize your data infrastructure and drive innovation in financial services. Learn More About the Capabilities of the Gemineye Data Lakehouse

In this edition of “A Day in the Life of a Data Analyst,” we interview Stephen Bradley, Data Integrations Manager at Nusenda Credit Union. Stephen has been working at Nusenda for over eight years and has helped the organization evolve into an industry pioneer in data-driven culture. Nusenda Credit Union is a $4.9B credit union headquartered in Albuquerque, NM. With over 20 branches across New Mexico, and four in Texas, they are the largest credit union in the area. They focus heavily on innovation and community engagement. How Stephen Bradley Got Started In Data Analytics Alicia Disantis: What got you interested in data analytics and credit unions? Stephen Bradley: Well, it’s kind of funny. I was never interested in data analytics to begin with. I went to college in 2003 and thought I was going to be an architect, so I started studying civil engineering. I did what they call “3/2 program” at Bethel University – Tiny Little Cumberland Presbyterian College in the middle of nowhere Tennessee. I was going to do three years there and then two years at Vanderbilt to finish off the degree program. But my staff advisor wanted me to take programming courses right out of the gate. I just couldn’t see how it connected until I got done with my first course and realized how highly structured and logical programming was. I fell in love with programming and was like, “I don’t want to draw buildings anymore. I think I want to go and do something with this.” Unfortunately for me, college didn’t work out too well. It was too expensive, and I was not in a place where I had financial assistance of any kind. I didn’t qualify for grants and was working a lot of student hours at a local grocery store, and still couldn’t make ends meet. I came back home to Albuquerque, NM and got a job at a call center up in Santa Fe, just answering the phones. On the side, I was teaching myself SQL server and got I got started with database administration and my certifications for Microsoft. I met with the IT boss at the time in the hallway at the call center one day and said, “Hey, I know you guys do good work, if you ever have a help desk position open, let me know. I’m willing to work my way up and get my foot in the door.” He blew me off, and two days later I was in HR, and I was worried it was a mistake asking him. But they offered me a job as a junior database administrator. I was really floored but really grateful. I’ve been in the IT space ever since…18 years. I’ve I worked for several different companies, then transitioned to Fidelity Investments in their health and welfare benefits administration. They manage all the health and welfare administration and payroll for a lot of Fortune 500 companies. I thought this was a great opportunity. What I didn’t realize is that much of their stuff was not necessarily data-driven, like coding and programming. It was more configuration – working on an Oracle platform – and I liked it. It was fun, new, and different. After a couple of years, I got tired of doing the 50 miles one way each way, five days a week, to Santa Fe from Albuquerque. And at the time, I had met my now wife, and we were about to be married. Now we’ve got four beautiful children. I needed to be more stable and this job wasn’t what gave me a passion to wake up in the morning. I found an aerospace manufacturer also here in Albuquerque called M-Core and that was some of the coolest work I’ve ever done in my career. We got to do NASA missions and solar panel manufacturing. I got to work on the Parker space probe; the last of the 12 science projects that Kennedy came up with, a “mission to touch the sun.” I got to help write software that tests the solar panels that went on the probe that is now orbiting the sun and will ultimately meet its demise in the sun. It was awesome to be a part of this, but again, with a wife and four children I was working 100 hours a week and that was not sustainable. I’d been a member of Nusenda Credit Union back when we were New Mexico Educators Federal Credit Union for many, many years. They had a job posting that came up right around the time I was feeling like I was spending too many hours working and not enough time with my family. I took the data integrations manager role at Nusenda and was introduced to the credit union movement. They have a leadership development program that I took right out of the gate and helped launch a project that started Community Day. This year, we had close to 600 of 900 employees go out and spend over 2,000 hours volunteering in the community and helping all the places that that we serve, all the way from Taos, NM down to El Paso, TX. Alicia: I love that. My experience in with New Mexico credit unions is that they are hugely committed to their communities. Stephen: It was a big draw of coming here. It’s a really fulfilling career. Nusenda CU’s Advanced Data Analytics Culture Every financial institution’s data analytics department is different. Can you tell me a little bit about your overall structure? Stephen: I report to Jeff Benefiel, our SVP of Digital and Core Operations. He’s responsible for everything from our online banking platform to our core systems that drive our financial technologies to the development team where we’re building custom software. These are peer departments to my department. Data Integrations is responsible for the ingestion processes, helping different systems that don’t natively talk as well as business intelligence. Whether that’s SSRS, automated emails and alert notifications based on business processes, or ...

Sandwich, Mass (January 14th, 2025) – Credit union and community bank data analytics provider Gemineye is delighted to announce that Maggie Chopp, long-time credit union champion, has joined the team as Director of Business Development. Chopp will be supporting Gemineye’s vision that data analytics should be accessible to credit unions and banks of all sizes, and she’ll bring her extensive analytics expertise to forge connections and community. “I am overjoyed to be joining the Gemineye team. Their focus on client experience, measurable results, and achievable strategies is perfectly aligned with my passion for helping credit unions set and reach their data goals. Our happy clients are our greatest achievement, and we look forward to bringing that experience to more community FIs.” Prior to joining Gemineye, Chopp was a Senior Consultant for a Microsoft third-party firm, where she specialized in Databricks and PowerBI development for a global clientele. Chopp’s unique background in both data analytics and business consulting allows her to deeply understand the challenges her clients face. The Gemineye was drawn not just to her dedication for helping credit unions and banks navigate the complexities of analytics, but her specific experience in the foundational blocks of the Gemineye platform – PowerBI and Databricks. “We are excited to have Maggie join the Gemineye team,” says Matt Jefferson, Chief Operating Officer at Gemineye. “We were impressed with her career path from a teller to analytics expert that allows her to understand our clients at a deeper level. Her proactive approach and industry experience are the perfect addition to our team and will help us in providing the best solution to our clients.” #### > Additional coverage by Finopotamus here

We offer complimentary consultations – never pushy, always honest.